We are seeking equity or blended finance partners to co-invest in these ventures. Capital requirements range from $3 million to $300 million depending on the project. Investors will gain access to high-growth African markets, with options to participate as lead sponsors, technical partners, or strategic advisors. Financial models, legal frameworks, and feasibility studies are available upon request.

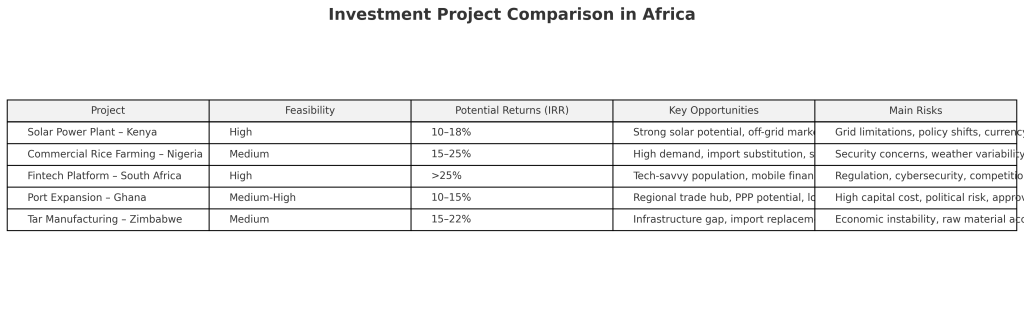

Here is a visual and analytical summary of five high-potential investment opportunities across Africa that we share currently working on. Each project is evaluated for its market potential, financial outlook, and associated risks.

Estimated IRR Comparison

Project Estimated IRR (%)

Solar – Kenya 14%

Rice – Nigeria 20%

Fintech – South Africa 30%

Port – Ghana 12%

Tar – Zimbabwe 18%

This chart compares the estimated Internal Rate of Return (IRR) across all five projects, with Fintech in South Africa leading in profitability due to high scalability and low fixed costs.

- Solar Power Plant – Kenya

Sector: Renewable Energy

Description: Development of a 20–50 MW solar farm targeting off-grid and industrial markets.

Market Opportunity: Strong solar potential, off-grid demand, green energy incentives.

Financial Highlights:

Investment: $20M–$50M

IRR: 10–18%

Payback: 5–8 years

Key Risks: Grid limitations, currency risk, policy changes.

- Commercial Rice Farming – Nigeria

Sector: Agribusiness

Description: Mechanized rice farming with integrated processing to reduce imports.

Market Opportunity: High rice consumption, government import restrictions, scalable model.

Financial Highlights:

Investment: $10M–$30M

IRR: 15–25%

Payback: 4–7 years

Key Risks: Security, climate risks, policy volatility.

- Fintech Platform – South Africa

Sector: Financial Technology

Description: A mobile platform for payments, microloans, and insurance for the unbanked.

Market Opportunity: High mobile use, inclusive finance demand, rapid scalability.

Financial Highlights:

Investment: $3M–$10M

IRR: >25%

Payback: 3–5 years

Key Risks: Regulation, cybersecurity, competition.

- Port Expansion – Ghana

Sector: Infrastructure

Description: Modernization of a strategic coastal port to boost trade efficiency.

Market Opportunity: West African trade hub, PPP potential, donor interest.

Financial Highlights:

Investment: $100M–$300M

IRR: 10–15%

Payback: 10+ years

Key Risks: High CAPEX, political risks, project delays.

- Tar Manufacturing – Zimbabwe

Sector: Construction Materials

Description: Bitumen/tar plant to meet infrastructure and road building needs.

Market Opportunity: Growing demand, import substitution, regional market access.

Financial Highlights:

Investment: $5M–$15M

IRR: 15–22%

Payback: 5–7 years

Key Risks: Economic instability, supply issues, regulatory delays.

Interested investors are invited to contact us for briefing. We welcome engagement with institutional investors, development finance institutions, impact funds, and sector-specialized venture capital firms.